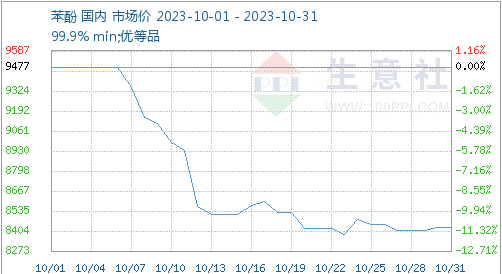

בחודש אוקטובר, שוק הפנולים בסין הראה מגמת ירידה באופן כללי. בתחילת החודש, שוק הפנולים המקומי נרשם במחיר של 9477 יואן/טון, אך עד סוף החודש מספר זה ירד ל-8425 יואן/טון, ירידה של 11.10%.

מנקודת מבט של אספקה, באוקטובר, מפעלי פנול קטונים מקומיים תיקנו סך של 4 יחידות, מה שגרם לקיבולת ייצור של כ-850,000 טון ואובדן של כ-55,000 טון. אף על פי כן, הייצור הכולל באוקטובר גדל ב-8.8% בהשוואה לחודש הקודם. באופן ספציפי, מפעל הפנול קטונים של Bluestar Harbin, המפיק 150,000 טון/שנה, הופעל מחדש והחל לפעול במהלך תחזוקה, בעוד שמפעל הפנול קטונים של CNOOC Shell, המפיק 350,000 טון/שנה, ממשיך להיסגר. מפעל הפנול קטונים של Sinopec Mitsui, המפיק 400,000 טון/שנה, יושבת למשך 5 ימים באמצע אוקטובר, בעוד שמפעל הפנול קטונים של Changchun Chemical, המפיק 480,000 טון/שנה, יושבת מתחילת החודש, וצפוי שזה יימשך כ-45 ימים. מעקב נוסף נמצא כעת בעיצומו.

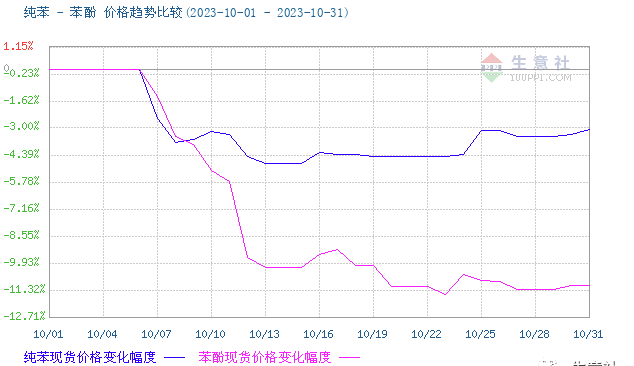

מבחינת עלויות, מאז אוקטובר, עקב הירידה המשמעותית במחירי הנפט הגולמי במהלך חג היום הלאומי, מחיר חומר הגלם בנזן טהור הראה גם הוא מגמת ירידה. למצב זה הייתה השפעה שלילית על שוק הפנול, שכן סוחרים החלו לעשות ויתורים על מנת לשלוח סחורות. למרות שמפעלים התעקשו על מחירי רישום גבוהים, השוק עדיין חווה ירידה משמעותית למרות הביקוש הכללי הנמוך. למפעל הטרמינל יש ביקוש גבוה לרכש, אך הביקוש להזמנות גדולות הוא יחסית נדיר. מוקד המשא ומתן בשוק מזרח סין ירד במהירות מתחת ל-8500 יואן/טון. עם זאת, עם המשיכה של מחירי הנפט הגולמי, מחיר הבנזן הטהור הפסיק לרדת והתאושש. בהיעדר לחץ על היצע הפנול החברתי, סוחרים החלו לדחוף את הצעותיהם באופן מהוסס. לכן, שוק הפנול הראה מגמת עלייה וירידה בשלבים האמצעיים והמאוחרים, אך טווח המחירים הכולל לא השתנה הרבה.

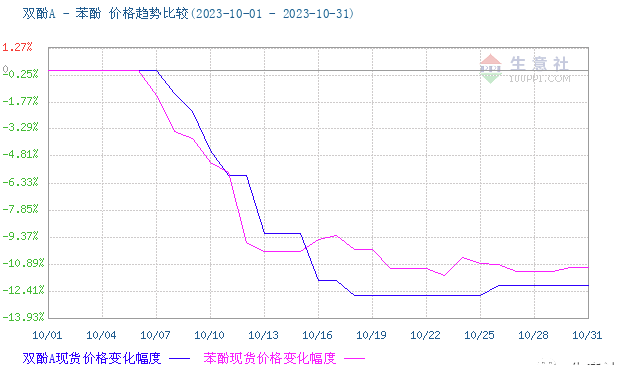

מבחינת הביקוש, למרות שמחיר השוק של פנול ממשיך לרדת, הפניות מהטרמינלים לא גדלו, והעניין ברכישות לא התעורר. מצב השוק עדיין חלש. המיקוד של שוק הביספנול A במורד הזרם גם הוא נחלש, כאשר המחירים המרכזיים שנקבעו במשא ומתן במזרח סין נעים בין 10,000 ל-1,0050 יואן/טון.

לסיכום, צפוי כי אספקת הפנול המקומית תמשיך לעלות לאחר נובמבר. במקביל, נשים לב גם לחידוש המלאי של סחורות מיובאות. על פי המידע הנוכחי, ייתכנו תוכניות תחזוקה ליחידות מקומיות כמו Sinopec Mitsui ו- Zhejiang Petrochemical Phase II של יחידות פנוליות קטון, אשר ישפיעו לטובה על השוק בטווח הקצר. עם זאת, למפעלי ביספנול A במורד הזרם של Yanshan Petrochemical ו- Zhejiang Petrochemical Phase II עשויות להיות תוכניות סגירה, אשר ישפיעו על הביקוש לפנול. לכן, Business Society צופה כי עדיין ייתכנו ציפיות כלפי מטה בשוק הפנול לאחר נובמבר. בשלב מאוחר יותר, נעקוב מקרוב אחר המצב הספציפי של השרשרת התעשייתית במעלה ובמורד הזרם, כמו גם אחר צד ההיצע. אם תהיה אפשרות לעליית מחירים, נודיע לכולם בהקדם. אך בסך הכל, לא צפוי מקום רב לתנודות.

זמן פרסום: 1 בנובמבר 2023